In the modern retail landscape, the shift from traditional barcode systems to RFID technology is not simply a hardware upgrade—it represents a strategic transformation across supply chain, store operations, and customer experience. This transition unfolds from a broad motivation through detailed design of channels and products, and culminates in measurable business benefits and high-profile brand adoption. The following text explores four major sections: the strategic impetus for transitioning from barcodes to RFID, the detailed implementation across channels and products, the operational and financial benefits, and the outlook for the future of connected retail.

For decades, barcodes have provided retailers with a low-cost and reliable way to identify items and track inventory. They are inexpensive to print, compatible with nearly every point-of-sale terminal and handheld scanner, and easy to integrate into existing retail workflows. However, the limitations of barcode technology have become increasingly apparent in a fast, data-driven retail world. Barcodes require line of sight, meaning each item must be individually scanned. This slows down operations, increases labor costs, and limits real-time visibility of inventory. Moreover, barcodes carry limited information—usually just a stock-keeping unit (SKU) or product ID—without supporting serialization, location tracking, or simultaneous reading of multiple items.

RFID technology offers a fundamentally different paradigm. By embedding a small chip and antenna into a label or tag, RFID enables radio signals to identify items automatically, without direct visual contact. Dozens or even hundreds of tagged items can be scanned in seconds, whether they are packed in boxes, hanging on racks, or stacked on pallets. This ability to read items remotely and in bulk transforms data collection into a continuous, automated process. RFID supports item-level tagging, meaning every product can have its own unique identity. It enables near-perfect inventory accuracy, reduces shrinkage, and delivers powerful analytics for stock movement and consumer demand.

The push toward RFID has been accelerated by several market trends. Consumers expect instant availability both online and in stores. Retailers are integrating multiple channels—physical stores, websites, and mobile apps—into seamless experiences such as buy-online-pick-up-in-store (BOPIS) and ship-from-store fulfillment. These models require highly accurate, real-time knowledge of inventory across all locations. Barcode systems, dependent on manual scanning and periodic stock counts, cannot meet this demand. RFID bridges this gap by allowing constant synchronization between physical stock and digital records.

The strategic case for RFID is thus clear: greater visibility, faster throughput, richer data, improved fulfillment, enhanced customer experience, and reduced loss. However, the transition is not merely about replacing one label with another—it demands a holistic redesign of retail processes, infrastructure, and data management. It is both a technological and organizational transformation.

Implementing RFID in Retail Operations

To carry out a transition from barcode to RFID, retailers must plan across multiple dimensions: tagging strategy, reader infrastructure, software integration, supplier collaboration, and staff training. The implementation typically begins with defining the tagging model—whether to apply RFID tags at the manufacturing source or later in the distribution or retail stage. Source tagging, where products arrive already tagged from the supplier, maximizes efficiency by allowing visibility throughout the supply chain. Store-level tagging may be used during pilot phases or for high-value products. Each option involves trade-offs in cost, control, and scalability.

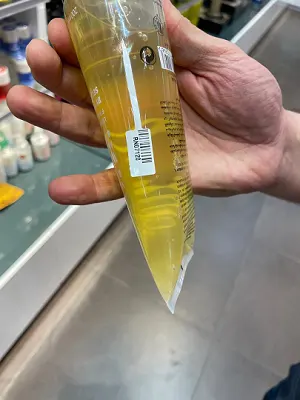

Product characteristics also influence tag selection. RFID tags vary by frequency, read range, and material compatibility. Ultra-high-frequency (UHF) passive tags are most common in retail, offering good range and low cost. Tags can be integrated into paper labels, fabric tags, or packaging. Some product types, such as apparel and footwear, are ideal for RFID due to consistent materials and high inventory turnover. Others, like liquids or metals, may need specialized tags to overcome interference.

Infrastructure deployment follows tagging. In warehouses, fixed RFID portals or tunnels automatically read tagged cartons as they pass through dock doors. In stores, handheld readers allow employees to perform full inventory counts in minutes instead of hours. Fixed readers can be installed at entry and exit points to detect movement, or in fitting rooms and shelves to monitor stock in real time. Some retailers combine RFID with smart mirrors and digital displays that react when tagged products are nearby, enhancing the shopping experience.

Integration with software systems is crucial. RFID read data must flow into enterprise resource planning (ERP), warehouse management (WMS), and point-of-sale (POS) systems. Each tag’s unique ID must correspond to a product record in the database, enabling real-time reconciliation of physical and digital inventory. This integration allows automatic replenishment, accurate sales tracking, and instant visibility of item availability across stores and online platforms.

Process reengineering accompanies the technology rollout. Inbound receiving processes become faster, as shipments are verified automatically when tags are read at the dock. Stockroom management improves because staff can locate misplaced items or verify replenishment needs instantly. At checkout, RFID readers allow multiple items to be scanned simultaneously, reducing waiting times. Even self-checkout becomes smoother since the system recognizes products automatically.

For omnichannel retailing, RFID is particularly powerful. With accurate real-time inventory, stores can fulfill online orders directly, locate specific items requested online, and reduce shipping errors. The technology supports advanced fulfillment strategies such as dynamic order routing—where systems automatically assign orders to the store or warehouse best positioned to fulfill them. RFID also aids loss prevention, as tags can double as electronic article surveillance elements, triggering alerts if unpaid items leave the store.

Training and change management are essential. Staff must learn how to handle tags, read zones, and equipment, and how to interpret RFID data in daily tasks. Since many retailers operate hybrid systems during transition, dual-marking—products labeled with both barcode and RFID—is common. This ensures compatibility with legacy processes while new RFID workflows are phased in. Suppliers also play a key role; retailers must align with them to guarantee tagging compliance and consistent data standards across the supply chain.

Implementation usually proceeds in stages. A pilot program may start in a limited number of stores or product categories, often apparel or electronics. Once operational workflows and data accuracy are validated, deployment expands gradually to additional stores and categories. Throughout, analytics help measure the impact on inventory accuracy, stockouts, sales uplift, and labor savings. The most successful rollouts are those that combine technical excellence with process redesign, supplier coordination, and employee adoption.

Business Success Stories

The benefits of RFID adoption are increasingly clear and quantifiable. Among the most significant gains are inventory accuracy, operational speed, reduced shrinkage, and improved customer satisfaction. Traditional barcode-based stock counts often achieve 60–80% accuracy due to human error and outdated records. RFID systems routinely deliver accuracy rates above 95%, ensuring that what appears in digital systems matches what is physically in stock.

Cycle counting becomes exponentially faster. What previously required hours of manual scanning can be done in minutes with a handheld reader sweeping across shelves or racks. This saves labor and allows more frequent counts, ensuring data freshness. Retailers report that RFID-based cycle counts can be performed 20 times faster than barcode equivalents, freeing employees for customer service rather than repetitive scanning tasks.

Operational efficiency improves throughout the supply chain. Automated receiving and shipping verification reduce errors and paperwork. In-store replenishment is more timely, minimizing stockouts and overstocking. With visibility of item-level movement, planners can optimize allocations, reduce safety stock, and lower working capital. For omnichannel operations, RFID enables precise fulfillment from any location, improving service levels and reducing shipping costs.

Loss prevention is another strong driver. Each RFID tag carries a unique identifier that remains active even after purchase records are linked, allowing systems to detect unregistered movements or fraudulent returns. This capability helps reduce theft and administrative shrinkage. When combined with analytics, RFID data can identify high-risk zones, theft patterns, and process inefficiencies.

From the customer’s perspective, RFID translates into better product availability, faster checkout, and new digital experiences. Smart fitting rooms can recognize items brought inside, suggest complementary products, or enable direct requests for different sizes. Mobile apps can guide shoppers to item locations in real time. These applications not only increase convenience but also reinforce brand engagement and satisfaction.

Financially, RFID adoption offers rapid return on investment. Many retailers achieve payback within one to two years due to reduced labor costs, improved inventory accuracy, and higher sales from avoided stockouts. The declining cost of tags—now often just a few cents per item—further improves feasibility even in mid-margin categories. As RFID infrastructure matures, its data also fuels advanced analytics, predictive restocking, and AI-driven demand forecasting, creating long-term strategic value.

Prominent retail brands demonstrate the success of this transformation. Global apparel chains have implemented item-level RFID tagging across thousands of stores, achieving near-perfect inventory visibility and boosting omnichannel performance. Fashion brands such as Zara and H&M use RFID to enable rapid restocking and real-time inventory synchronization between physical stores and online systems. Sportswear giants have embedded RFID tags in every product to streamline distribution, manage authenticity, and enhance the customer experience. Department stores and luxury labels have integrated RFID into packaging to track product journeys and combat counterfeiting.

Despite these advantages, challenges remain. Initial investments in infrastructure, training, and supplier coordination can be significant. Integration complexity and data management require technical expertise. Tag performance can vary with product material or store layout. For low-value or disposable items, the cost-benefit ratio may still favor barcodes. Retailers must therefore adopt RFID strategically, targeting product lines and processes where impact is greatest. A phased, data-driven approach ensures scalability and mitigates risk.

The Future of Retail Intelligence

The migration from barcode to RFID marks a new era of connected retail. It bridges the physical and digital realms, creating a live ecosystem of products, shelves, and systems that communicate continuously. Retailers gain unprecedented operational visibility, agility, and intelligence. Consumers benefit from accuracy, speed, and personalization.

As costs decline and standards mature, RFID adoption will extend beyond apparel to groceries, cosmetics, and other sectors. It will integrate with artificial intelligence, blockchain, and Internet of Things (IoT) platforms, enabling full product traceability and predictive insights. Retailers that leverage RFID data will not only optimize operations but also unlock new customer engagement models driven by real-time analytics.

The journey requires commitment, but the rewards are transformative. Retailers that act early are already seeing the advantages—leaner operations, smarter supply chains, stronger brand loyalty, and data-driven decision-making.